May 2, 2016

Reflecting on National Fair Housing Month (April, 2016), we must acknowledge the many farreaching initiatives on the national, state, and local levels to expand fair housing protections to more and more deserving classes. Most notably, New York State became the first state in the nation to prohibit harassment and discrimination “on the basis of gender identity, transgender status or gender dysphoria” (9 NYCRR 466.13).

On the federal level, an equally expansive classification system has been adopted by the U.S. Department of Housing and Urban Development (HUD) and will have sweeping effects on fair housing claims throughout the nation. Known as the “disparate impact” test, discrimination claims may now be asserted by any number of heretofore unrecognized groups or classes.

In a landmark case, Texas Department of Housing & Community Affairs

v. The Inclusive Communities Project, Inc. (135 S. Ct. 2507 (U.S. 2015)),

the United States Supreme Court held that “disparate impact” claims may be

brought under the federal Fair Housing Act (42 U.S.C. §3604). These claims allege that a policy is discriminatory merely because it has an adverse impact on a group or “protected class;” even in the absence of an overt discriminatory intent. Under federal law, these protected classes include race, color, national origin, religion, sex, familial status and handicap. But as noted above, state and local laws and regulations have expanded this list to include additional protected groups such as sexual orientation, gender identity, age, military status, domestic violence victim status, and recipients of lawful sources of income. Today, with the implementation of the “disparate impact” test, new “quasiclasses” can emerge; the most notable of which (so far) is criminal history.

In its entirety, criminal history is not considered a protected class deserving of fair housing protection. One could however argue, with statistical certitude, that a policy of denying housing to all persons arrested and/or convicted of a crime would have a “disparate impact” on some minority groups and therefore should be considered a discriminatory practice. This is, in fact, the official opinion of HUD: “Criminal records based barriers to housing are likely to have a disproportionate impact on minority home seekers” (Of ice of General Counsel Guidance on Application of Fair Housing Act Standards to the Use of Criminal Records by Providers of Housing and Real EstateRelated Transactions, 4 April, 2016). Consequently, such a “faciallyneutral policy” will be considered a violation of “the [Fair Housing] Act if it is not supported by a legally sufficient justification.”

Yes, a homeowner may be justified in denying housing based on criminal history. But, what certainly will not pass scrutiny under the new test is a blanket policy of refusing all applicants with a criminal record. Rather, landlords are now charged with exercising reasonable discretion under a general policy that considers many factors and is applied equally to all applicants. At the minimum, a landlord should consider:

- What was the nature of the crime(s)?

- At what age were the crimes committed?

- How long ago did they occur?

- Were there multiple convictions or arrests?

- What rehabilitative steps have been taken?

Of course, anytime that a private individual’s discretion affects the housing rights of others, challenge is sure to ensue. For this reason, it is incumbent upon the agent to inform landlords and sellers of their duties under all applicable fair housing laws. A Fair Housing Disclosure must be executed simultaneously with an agency agreement. Considering the unbalanced risk to reward ratio in most rental scenarios and the staggering cost of litigation for all fair housing claims, copious record keeping is a must both for the agent and the homeowner alike. An agent should not, however, provide a homeowner with a fair housing policy as this may be deemed as engaging in the unauthorized practice of law.

The “disparate impact” test is sure to change the landscape of fair housing litigation in the months and years to come. In an interesting application of the test and of particular interest to eastend professionals is its use in challenging the legality of the new Town of Southold shortterm rental law (Southold, New York, Municipal Code Art. I, § 2804 (2015). A group of Southold homeowners argue that the town’s requirement of a minimum rental term of fourteen days has a “disparate impact” on families with children. They argue that “the special characteristics of modern day families rarely allow for a shortterm rental of two weeks or more” (Katsh, Salem M. (KatshLaw LLC) Letter to: Honorable Town Board (Town of Southold, NY) 2016 Mar. 24). Consider also the heightened enforcement initiatives likely to ignite a new surge of fair housing litigation. Governor Cuomo’s Fair Housing Enforcement Program launched in February of this year, for example, specifically commissions public “testers” to pose “as potential renters or home seekers and [uncover] discriminatory bias amongst sellers and landlords.”

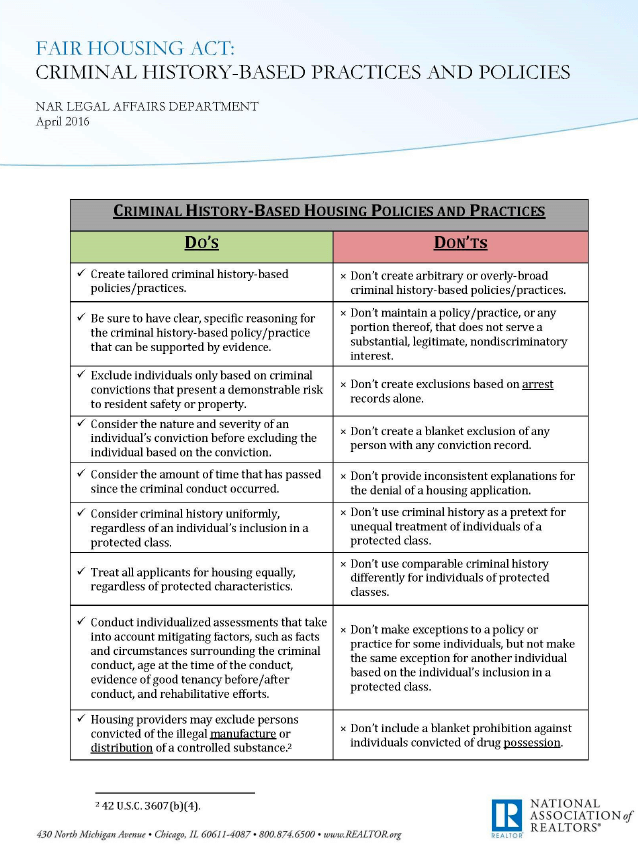

With so much at risk within such a dynamic environment, agents simply cannot trust that a homeowner will act appropriately within all applicable fair housing constraints. Affirmative steps must be taken to ensure that homeowners are wellinformed and that the agent does not unwittingly participate in a discriminatory scheme. Again, discriminatory intent is NOT a prerequisite to a fair housing claim. As for criminal history, the attached list of “Do’s and Don’ts” issued by the National Association of REALTORS© will surely prove a valuable reference guide to homeowners and agents alike.

Michael Ferruggia is a founding partner of the law

firm of Ferruggia & Calisto, LLP with offices in

Central Islip and Southampton, New York. Mr.

Ferruggia represents an extensive base of

institutional, corporate, and private clientele in real

estate and lending transactions and real estate

litigation matters. Mr. Ferruggia has also served as an

Adjunct Professor of Law at both the Patchogue and

Bethpage, New York campuses of Briarcliffe

College. In 2013, Mr. Ferruggia founded The New

York Center of Real Estate (NYCORE); a fully

accredited real estate school offering Continuing

Education programs to real estate professionals. Mr.

Ferruggia currently serves as Counsel to the Board of

the Hamptons North Fork REALTORS® Association (HANFRA).